Did Your Home Outperform the Market?

2000

$

$

You could have made

$0

more if you had invested in the S&P 500*

* This comparison is hypothetical and for illustrative purposes only. S&P 500 returns reflect total return from June of the purchase year through June 2025. Home value inputs are user-provided. Past performance is not indicative of future results.

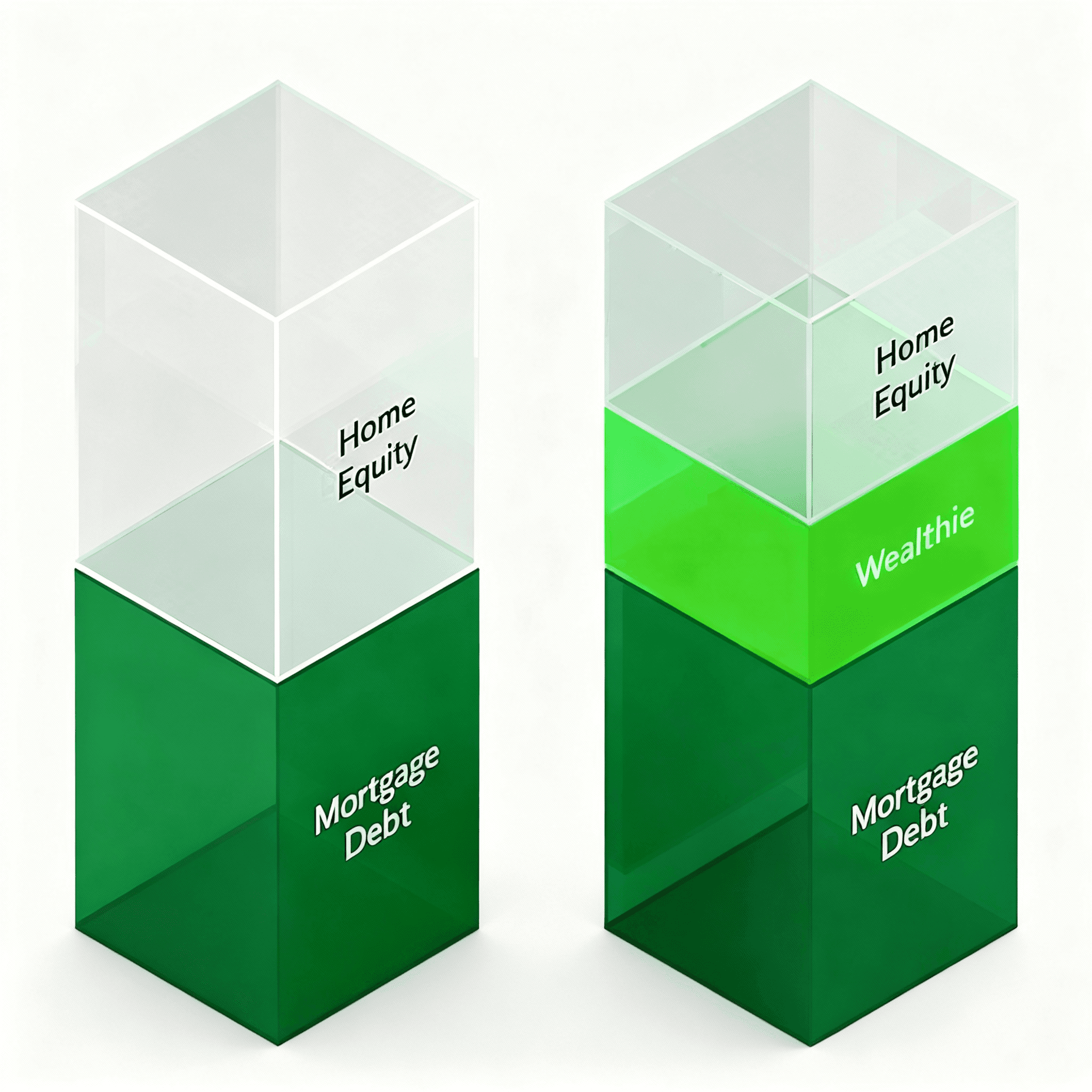

Wealth is Not Built Just by Owning

Homeownership leaves more wealth on the table than it generates, forcing everyday homeowners to miss out on the benefits of investing in the market.

Since 1995, homes have appreciated ~3x while the S&P 500 has grown ~21x

Wealthy Americans invest in the market

Middle class Americans have the majority of their wealth in their homes

Wealth is Built by Optimizing

Wealthie is the bridge that enables homeowners to invest more money and achieve financial goals while being a homeowner.

Unlock your most important asset

Make home equity work harder for you

Invest where you need and want

Our Mission: Make Homeowners Wealthie

Enjoy the Pride of Homeownership

Passively grow wealth and income beyond your home

Make Home Equity Work Harder for You

Invest in your future and maximize your returns while living at home

No Loans, No Payments, Minimal Fixed Fees

Use future appreciation of your home to hit your financial and wealth goals

The WISE Decision: Put Home Equity to Work

Grow Your Wealth from Your Home Equity

A Wealth Investment Shared Equity (WISE) agreement enables homeowners to invest their home equity in safe, simple, and responsible assets such as a S&P 500 ETF or bond funds, turning idle equity into long-term growth.

Keep Ownership and Gain Flexibility

You can live in your home and invest at the same time! A WISE agreement lasts up to 30 years. There are no monthly payments and you can choose when to end the agreement by selling your home or repurchasing Wealthie’s share.

What Is the Wealthie Difference?

Backed by the Best Investors

What does Wealthie do?

How does it work?

What is the WISE agreement’s term length?

What is the difference between a WISE agreement and a HELOAN or HELOC?

Is it easy to sell my home if I have a WISE agreement?

Who owns my home under Wealthie’s agreement?

What happens if I pass away?

Do you allow second homes or investment properties?

What if there is a mechanic’s lien against my property?

Do I need permission to remodel my home?